A Firm Which Uses the Aggressive Financing Strategy

The most likely consequence of this action is ________. It increases return and increases risk.

Chapter 16 Short Term Business Financing Multiple Choice 1 The

Which of the following is true of an aggressive funding strategy of a firm.

. At the operating breakeven point ________ equals zero. C an undetermined change in the current ratio. 99 A firm which uses the aggressive financing strategy plans to purchase raw materials in large quantities to take price discounts.

A a decrease in the current ratio B an increase in net working capital C a decrease in the risk of insolvency D an increase in long-term debt Answer. Finance questions and answers. The firm will finance the purchase with a loan.

The most likely consequence of this action is aa decrease in the current ratio. A financial B operating C capital D direct 10 If a firm uses an aggressive financing strategy A it increases return and increases risk. The most difficult set of accounts to predict are _____.

The firm will finance the purchase with a long-term loan. Ban increase in net working capital. A firm which uses the aggressive financing strategy plans to purchase a major fixed asset financed with a loan.

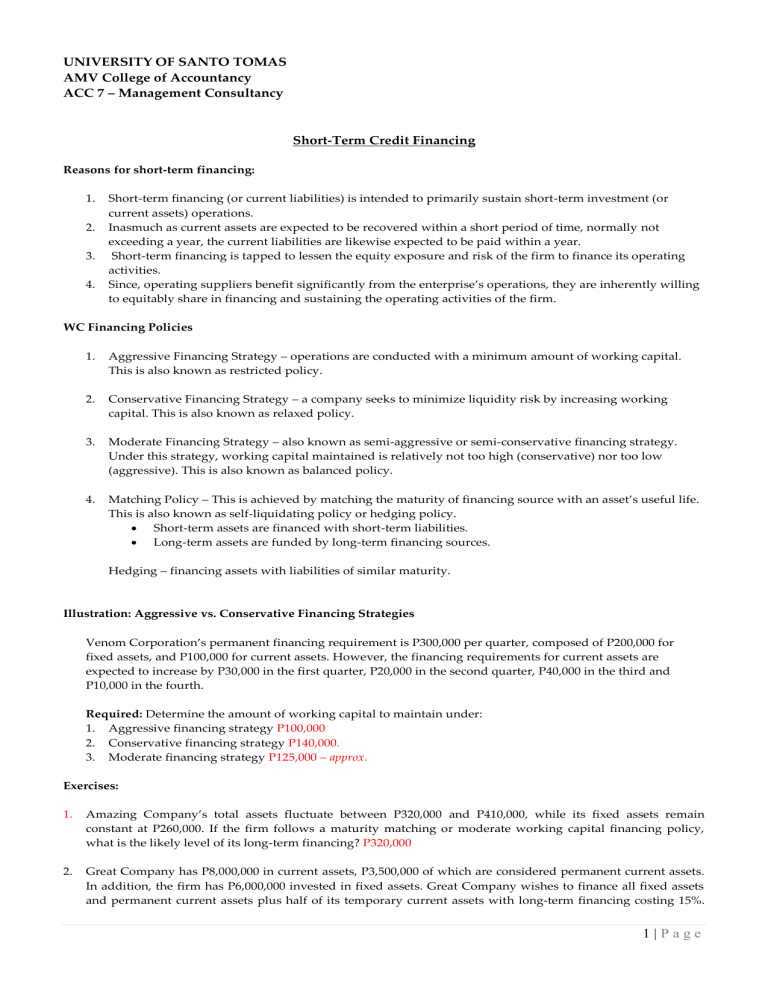

A firm that follows an aggressive working capital financing approach uses primarily short-term credit and thus is more exposed to an unexpected increase in interest rates than is a firm that uses long-term capital and thus follows a conservative financing policy. If a firm uses an aggressive financing strategy it _____ return and _____ risk. Under an aggressive funding strategy a firm funds it seasonal requirements with bonds and long-term.

9 Assets leased under leases generally have a usable life longer than the term of the lease. 89 A firm which uses the aggressive financing strategy plans to purchase a major fixed asset financed with a loan. 95 If a firm uses an aggressive financing strategy _____.

The firm will finance the purchase with a loan. The most likely consequence of this action is A a decrease in the current ratio. Under an aggressive funding strategy a firm funds both its seasonal and its permanent requirements with long-term debt.

Credit Analysis _____ is the procedure for evaluating mercantile credit applicants. The aggressive financing strategy is a strategy by which the firm finances all projected funds requirements with long-term funds and uses short-term financing only for emergencies or unexpected outflows. B an increase in net working capital.

The amount of time that elapses from the point when the firm makes an outlay to purchase raw materials to the pint when cash is collected from the sale of the finished good. C aggressive and conservative. The firm will finance the purchase with a loan.

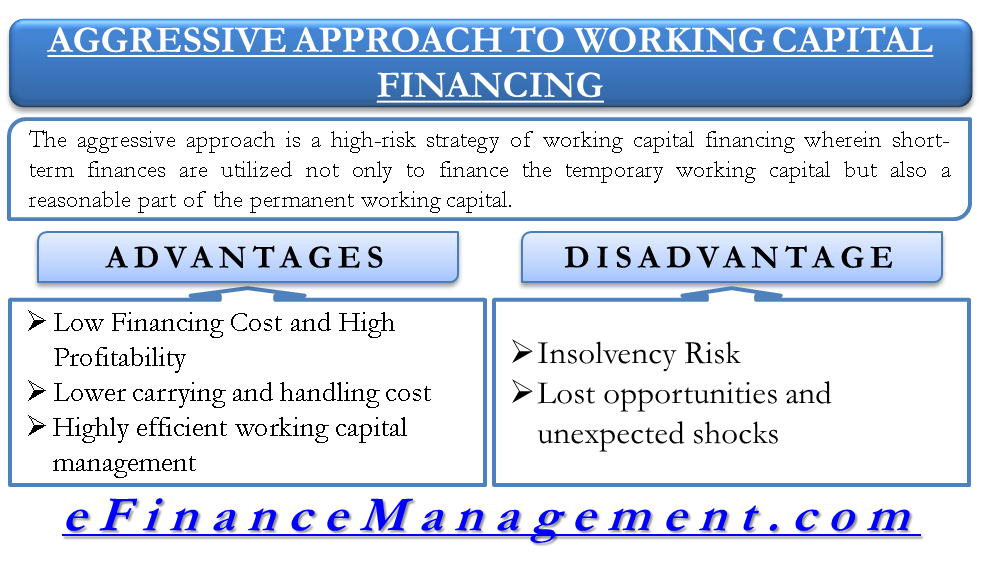

90 A firm which uses the aggressive financing strategy plans to purchase raw materials in large quantities to take price discounts. Aggressive Approach to Working Capital Financing. B an increase in net working capital.

AnswerD 90A firm which uses the aggressive financing strategy plans to purchase raw materials in large quantities to take price discounts. Finance The aggressive funding strategy is a strategy by which a firm finances all projected funds requirements with longterm funds and uses shortterm financing only for emergencies or unexpected outflows. A it increases return and increases risk B it increases return and decreases risk C it decreases return and increases risk D it decreases return and decreases risk Answer.

The most likely consequence of this action is ________. In this approach to financing the levels of inventory accounts receivables and bank balances are just. Asked Dec 21 2018 in Business by Photographer.

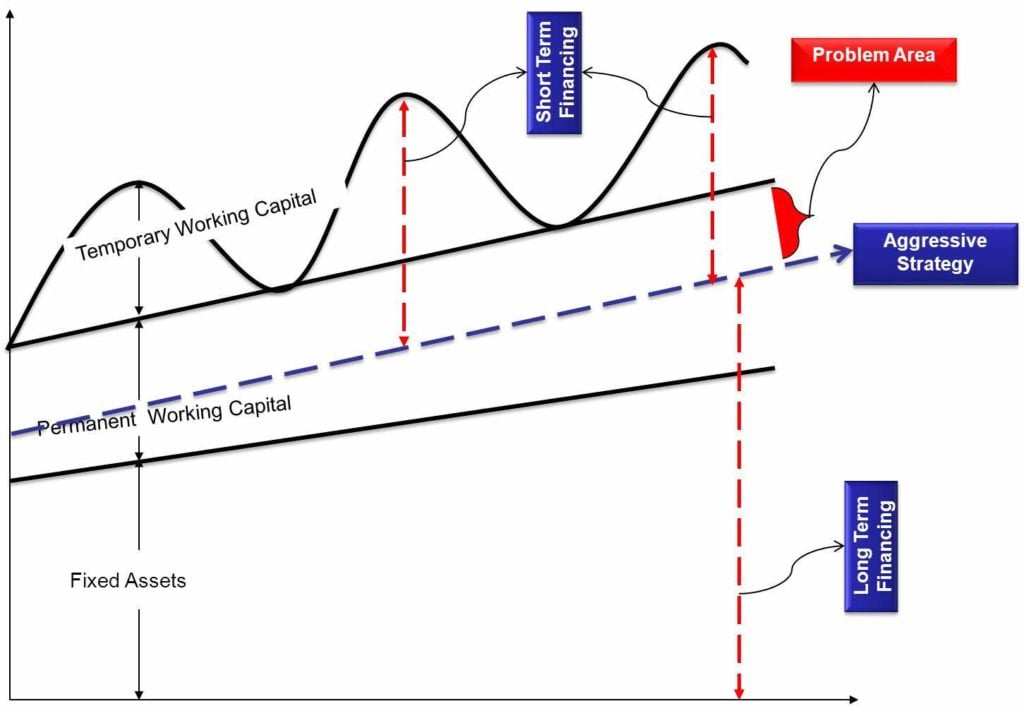

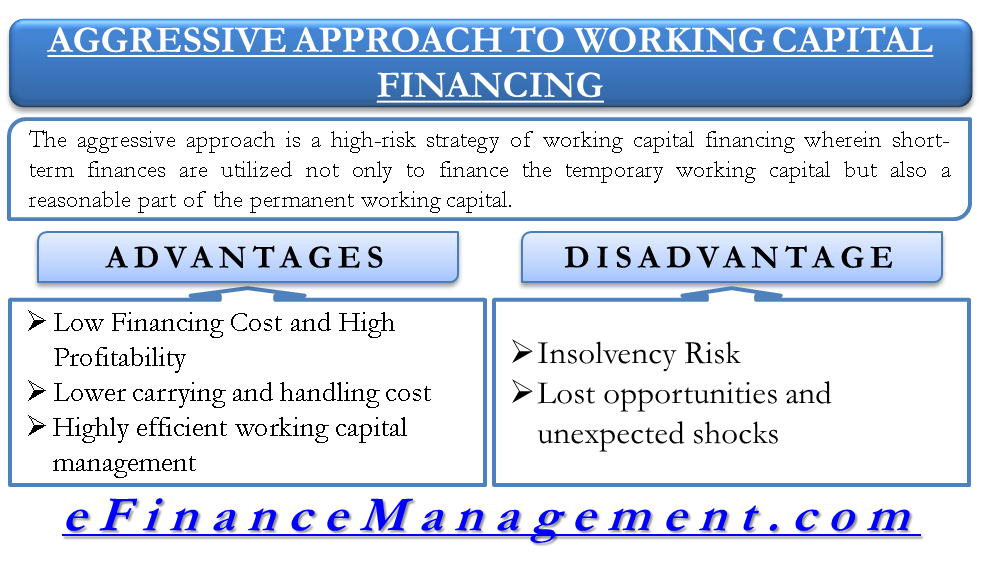

The aggressive financing strategy is a strategy by. The aggressive approach is a high-risk strategy of working capital financing wherein short-term finances are utilized to finance the temporary working capital and a reasonable part of the permanent working capital. An aggressive financing strategy is a financing strategy under which a company funds its seasonal requirements with short-term debts and its permanent requirement with long-term debt.

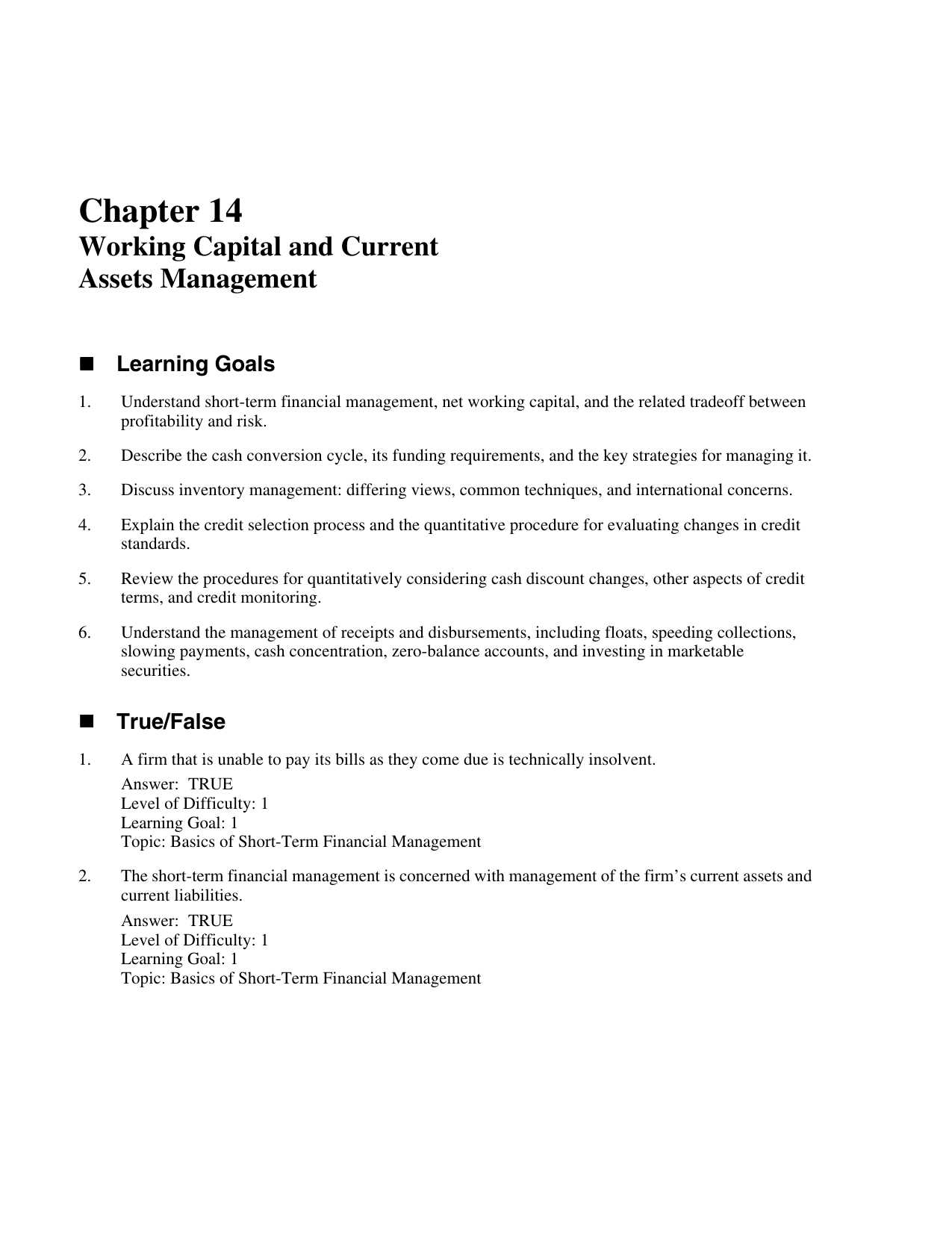

LG 2 Learning Outcome. The two major sources of short-term financing are. The inventory conversion period the.

If the firm uses an aggressive financing strategy. This is a very risky approach as there are chances that the organization might have a hard time dealing with its short-term obligations. Problems show your work 1 Point 11.

If a firm uses an aggressive financing strategy 9. The most likely consequence of this action is A a decrease in the current ratio. The aggressive financing strategy is a strategy by which the firm finances all projected funds requirements with long-term funds and uses short-term financing only for emergencies or unexpected outflows.

Funding Requirements of the Cash Conversion Cycle Learning Obj. 28A firm which uses the aggressive financing strategy plans to purchase raw materials in large quantities to take price discounts. D current and fixed.

As per this financing strategy the organization uses its short-term funds to finance a part of its permanent assets. It is the most profitable method of managing working capital but it comes with the most risk. Xiao Li wishes to accumulate 50000 by the end of 10 years by making equal annual end-of-year deposits over the next 10 years.

A firm that follows an aggressive current asset financing approach uses primarily short-term credit and thus is more exposed to an unexpected increase in interest rates than is a firm that uses long-term capital and thus follows a conservative financing policy. The lower risk of a conservative strategy also results in reduced profits because of the higher interest rate costs of long-term debt. B short-term and long-term.

Managers who are risk-takers are more comfortable with an aggressive financing strategy. A a decrease in the current ratio. The cash conversion cycle CCC combines three factors.

The most likely consequence of this action is _____. Its heavy reliance on short-term financing makes it riskier because of interest rate swings and possible difficulties in obtaining short-term quickly when seasonal peaks occur.

14 Working Capital And Current Asset Management By Gitman

Pdfcoffee Com Ust Wc Finance With Answers 1 Pdf Free

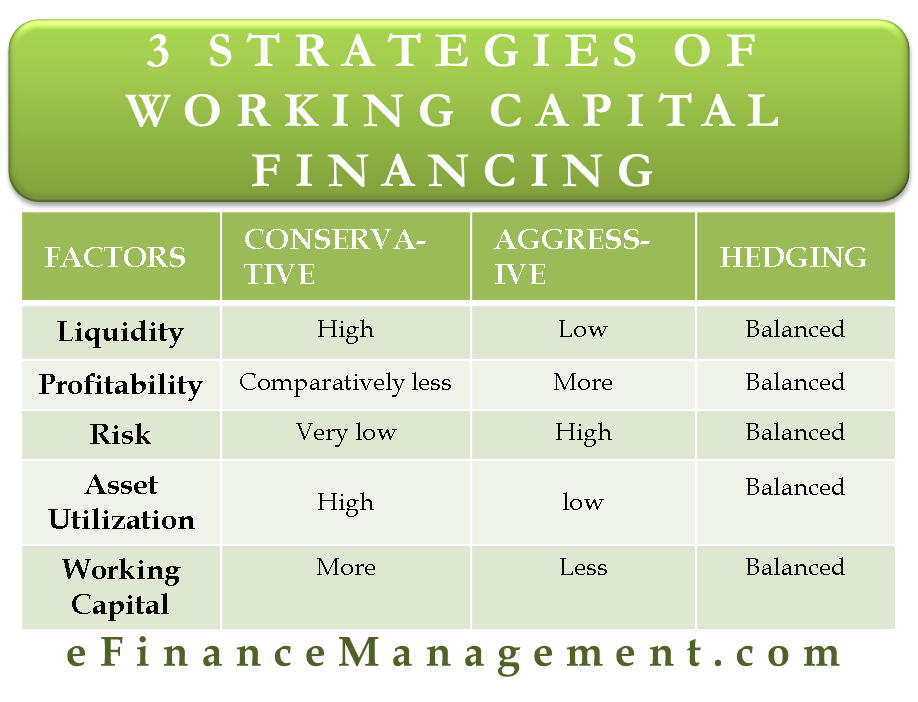

Compare 3 Strategies Of Working Capital Financing

Working Capital Financing What It Is And How To Get It

Working Capital Management Conservative Approach Efm

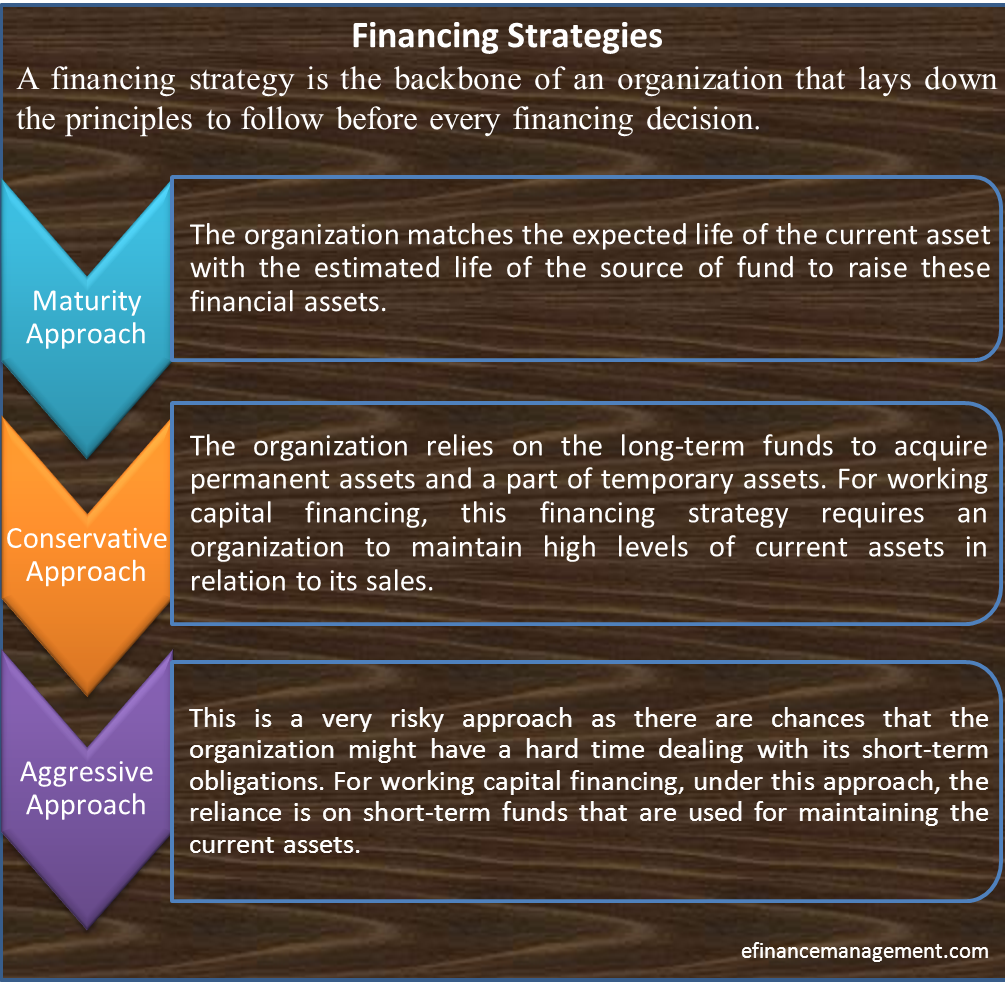

Financing Strategies Matching Conservative Aggressive Approach

Working Capital Management Strategies Approaches

Financing Strategies Matching Conservative Aggressive Approach

Working Capital Financing What It Is And How To Get It

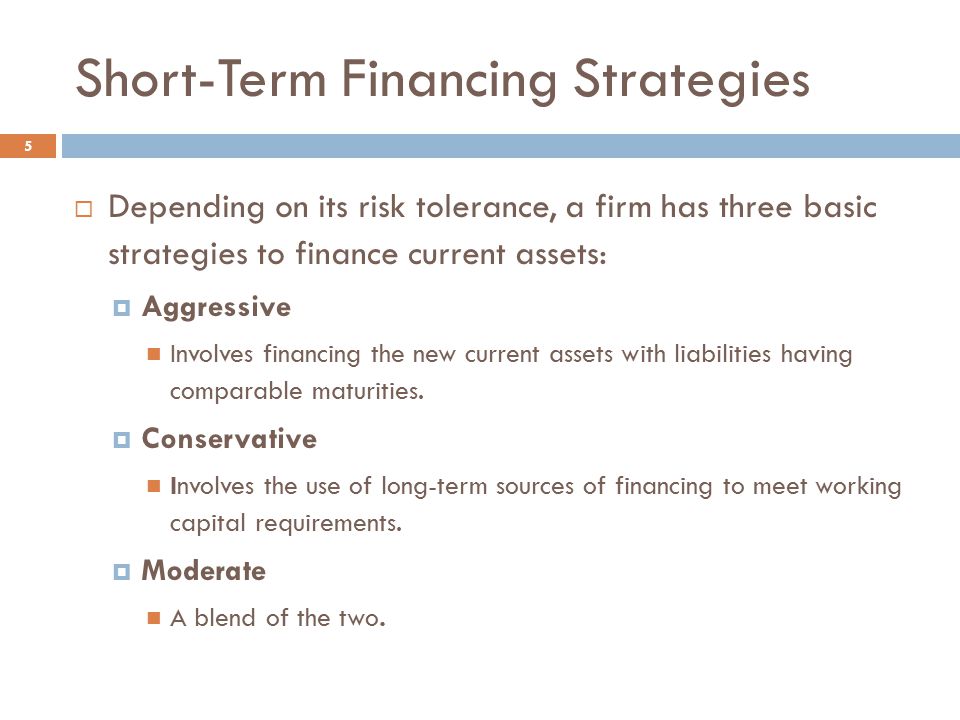

Short Term Financial Management Ppt Video Online Download

What Are The Approaches To Working Capital Management Enterslice

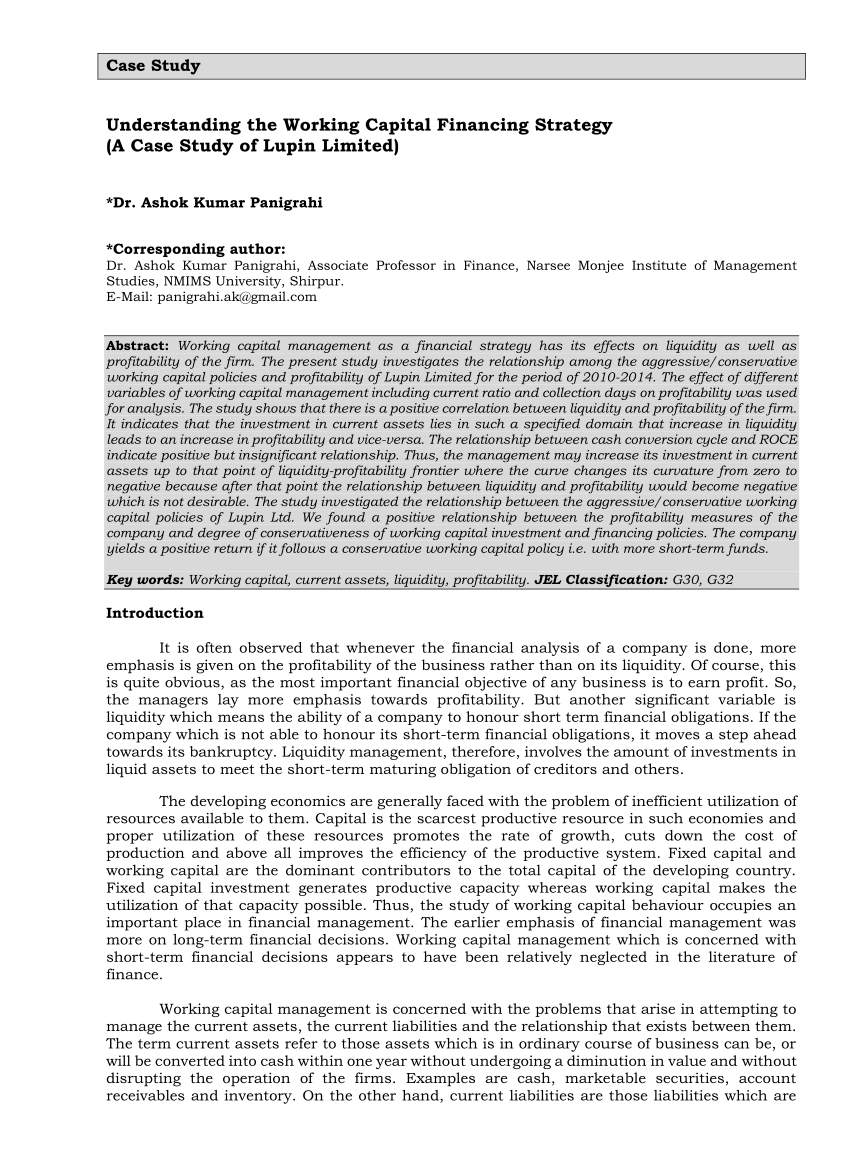

Pdf Understanding The Working Capital Financing Strategy A Case Study Of Lupin Limited

What Are The Approaches To Working Capital Management Enterslice

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

Use Of Financial Leverage In Corporate Capital Structure

Short Term Financial Management Ppt Video Online Download

Aggressive Approach To Working Capital Financing Management Efm

Aggressive Approach To Working Capital Financing Management Efm

Comments

Post a Comment